Cyclically, over time, the stock market constantly expands and then shrinks. In that respect, one should understand these cycles of fluctuation with a proper notion of their characterization to enable correct decisions, timely optimizations, and evasion of usual pitfalls.

Through this article, we look at the four big phases of a stock market cycle, what actually drives a phase, and how traders could adapt their style of trading with respect to changing markets.

Stock Market Cycles: What’s This?

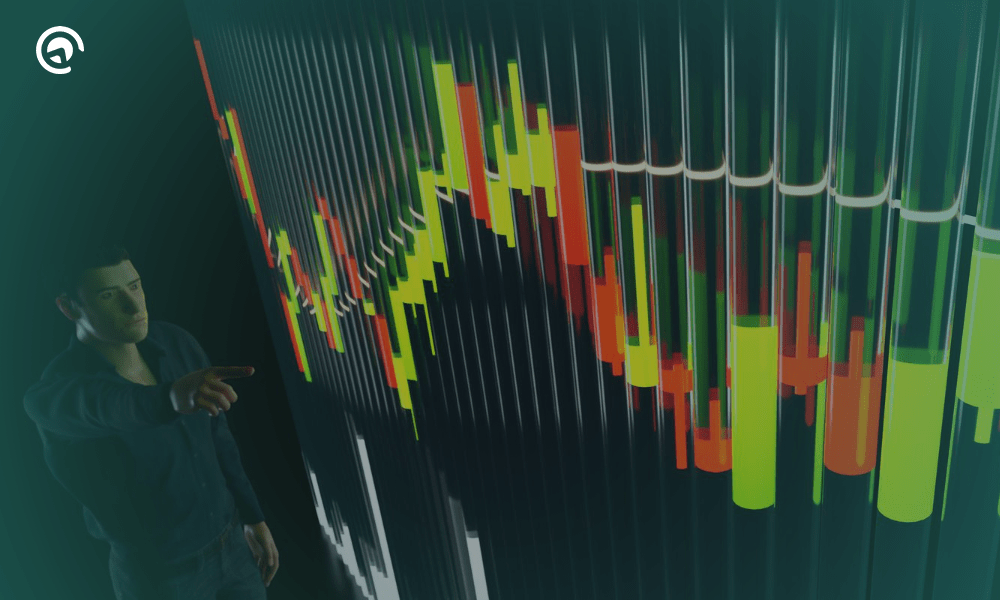

A stock market cycle is a periodic pattern of economic and financial market movements. Because there is no fixed time frame for cycles to complete, they most often move through four important phases: accumulation, uptrend, distribution, and downtrend. In general, these cycles are influenced by the economic conditions, investor sentiment, corporate earnings, and central bank policies.

Grasping such phases will enable traders to try to predict market fluctuations and adjust their strategies appropriately.

The Four Phases of the Stock Market Cycle:

1. Accumulation Phase: The Bottoming Process

The accumulation phase of the cycle comes after a long-term downtrend when investor sentiment is at its lowest. Market participants are pessimistic, and fear dominates trading behavior. However, smart money—such as institutional investors, hedge funds, and seasoned traders—starts buying up stocks at low prices in anticipation of recovery.

Key characteristics of the accumulation phase include:

- Low trading volumes as uncertainty remains high.

- Stock prices trading near long-term lows.

- Economic data showing early signs of improvement.

Traders who recognize this phase can adopt a long-term investment approach, gradually building positions in fundamentally strong stocks before the broader market turns bullish.

2. Uptrend Phase: The Bull Market Begins

It is during this period that the market enters the uptrend phase, where stock prices are rising, economic indicators improve, and investor confidence rises. This is usually propelled by good earnings reports, accommodative monetary policies, and strong consumer spending.

In the uptrend phase:

- Stock prices steadily rise, marking higher highs and higher lows.

- Trading volume improves as more investors jump into the market.

- Media coverage becomes increasingly positive, drawing in the retail traders.

Traders in this phase typically adopt momentum strategies, focusing on trending stocks with strong earnings growth. Buying pullbacks and breakouts can be effective approaches, as long as risk management is maintained.

3. Distribution Phase: Signs of Market Exhaustion

Actually, distribution is the final stage of a bull market where the participants of the market start taking profits. Prices may still rise in this phase but become more volatile and are often pulled back. During this phase, smart money or institutional investors start reducing exposure to the market, while retail traders and latecomers continue buying, expecting higher prices.

Key Indicators of Distribution Phase:

- Increased volatility and erratic movements in prices.

- Divergence between leading stocks and the overall market

- A change in market psychology- uncertainty sets in, replacing optimism.

Traders should be cautious at this stage because signs of weakness here might be an indication of a downturn. At this phase, one should set stop-loss, and check on the moving averages and relative strength to prevent massive losses.

4. Down trend Phase: The Bear Market

The bear market, or downtrend phase, is characterized by falling stock prices, shrinking corporate earnings, and general pessimism. These phases are usually triggered by economic recessions, increases in interest rates, and global crises.

In a bear market:

- Stock prices see sharp declines, with breaks below key support levels.

- Investor sentiment becomes negative, with panic selling leading the way.

- Safe-haven assets start to look more attractive, including gold and bonds.

Traders must shift their strategy to one of defense. Either short-selling, trading inverse ETFs, or focusing on haven assets can provide potential profits during a downturn.

How to Trade Each Market Cycle Phase?

Accumulation Phase Strategies

The trader should look to invest in undervalued stocks with strong fundamentals and signs of institutional buying. Dollar-cost averaging is a good strategy since it enables gradual accumulation without trying to time the exact bottom.

Uptrend Phase Strategies

During the uptrend, traders can:

- Buy stocks breaking above resistance levels.

- Use moving averages to identify strong trends.

- Ride momentum while maintaining stop-losses to protect gains.

How to Trade During Distribution Phase?

The name itself suggests that this phase requires some serious risk management. Traders should:

- Reduce exposure to speculative assets.

- Watch for technical breakdowns and trend reversals.

- Use trailing stops to lock in profits.

How to Trade During Downtrend Phase?

Bear markets call for mostly defensive tactics:

- Shorting stocks or using put options to benefit from declines.

- Holding cash or investing in defensive sectors such as healthcare and utilities.

- Monitoring central bank policies for potential reversals.

Conclusion:

Stock market cycles are inevitable, but recognizing their phases can help traders make better decisions. The accumulation, uptrend, distribution, and downtrend phases each present unique opportunities and risks. By adapting strategies based on market conditions, traders can enhance their profitability and protect capital during turbulent times.